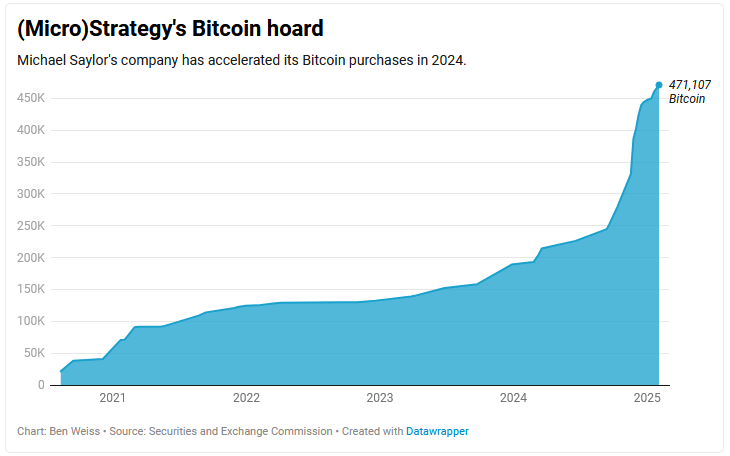

MicroStrategy, founded in 1989 as a business intelligence (BI) software company, has undergone a dramatic strategic pivot in recent years. In August 2020, CEO Michael Saylor announced MicroStrategy’s first Bitcoin purchase – 21,454 BTC for about $250 million – kicking off a new corporate strategy of using Bitcoin as its primary treasury asset. Over the next few years, MicroStrategy doubled down on this approach, raising capital via debt and equity to acquire even more Bitcoin:

The ongoing investment in Bitcoin raises significant risks for MicroStrategy customers, affecting their trust and reliance on the company’s BI products.

By late 2024, the company had “officially morphed from an enterprise software firm into a Bitcoin behemoth”, accumulating hundreds of thousands of BTC at a record pace.

This pivot has been so pronounced that MicroStrategy’s identity and market profile are now largely defined by its cryptocurrency holdings rather than its BI software business. In 2022, Saylor stepped down as CEO (becoming Executive Chairman) explicitly to focus on Bitcoin acquisition and advocacy, handing day-to-day corporate operations to a new CEO. And in early 2025, the company even rebranded itself as “Strategy,” proclaiming it is “the world’s first and largest Bitcoin Treasury Company” alongside its BI offerings. In short, MicroStrategy has transformed from a BI software vendor into a hybrid BI-and-crypto company with an unprecedented emphasis on Bitcoin.

MicroStrategy is by far the largest corporate holder of Bitcoin, with a cryptocurrency stash dwarfing that of any other public company. As of late 2024 it held an estimated 386,700 BTC (worth over $31 billion) – more than 1.2% of Bitcoin’s total supply.

This outsized Bitcoin exposure illustrates how MicroStrategy’s identity has shifted, raising questions for its traditional BI customers.

Impact on Business Intelligence Customers

Neglect of BI Product Innovation – One major concern for MicroStrategy’s BI customers is that the leadership’s intense focus on Bitcoin could lead to neglect of its analytics platform. The company’s top executives and resources may be distracted by cryptocurrency strategy at the expense of software development. Notably, MicroStrategy’s core software business has shown signs of stagnation since the pivot: revenue fell to $463 million in 2024, the lowest since 2010 (marking a third consecutive year of decline). The firm’s “bread-and-butter” BI operations have stalled, and headcount dropped 22% from 2020 to 2024 – a period during which the company was aggressively buying Bitcoin. This downturn suggests that MicroStrategy has not been heavily investing in expanding or innovating its BI products, raising red flags that its analytics platform might not see the same attention and improvement as competitors’ offerings. If leadership is preoccupied with managing a massive crypto treasury, customers fear the pace of product updates, new features, and innovation in the MicroStrategy BI suite could slow, leaving them with a stagnant toolset.

Reduction in R&D for Analytics – Relatedly, there are concerns that MicroStrategy’s pivot will divert research and development budgets away from its BI and analytics technology. Every dollar (and hour) spent on Bitcoin initiatives is one not spent enhancing the BI platform. MicroStrategy’s executives have started investing engineering effort into Bitcoin-related software – for example, building applications on the Lightning Network and other blockchain projects.

These industry reactions reflect the heightened risks for MicroStrategy customers who depend on the company’s analytics capabilities.

Amid these discussions, analysts emphasize the risks for MicroStrategy customers tied to the company’s strategic focus on Bitcoin.

Risks for MicroStrategy Customers

This dual focus brings forth substantial risks for MicroStrategy customers that may influence their decision-making.

Despite these assurances, the very need to make such a statement underscores customer worry that BI R&D could take a back seat. If MicroStrategy is splitting its product development attention between BI features and crypto tech, its analytics platform may advance more slowly or lose ground in usability, data visualization, AI integration, and other key areas. Compounding this, the company’s financial priorities have clearly shifted – executives credit the software business primarily as a cash engine to buy more Bitcoin – which may signal fewer resources reinvested into the BI product itself. For BI clients who rely on continuous improvement and innovation from their vendor, this trend is unsettling.

In navigating these challenges, understanding the risks for MicroStrategy customers is vital for informed decision-making.

Thus, the risks for MicroStrategy customers are becoming a focal point in discussions about BI strategies.

In conclusion, the existing narrative around the risks for MicroStrategy customers underscores the need for vigilance.

Ultimately, understanding the risks for MicroStrategy customers will empower organizations to make strategic choices.

Product Support, Reliability & Long-Term Viability – BI customers are also questioning MicroStrategy’s reliability and commitment as a long-term analytics partner given its strategic shift. The fear is that with leadership fixated on Bitcoin, the quality of customer support, technical services, and product roadmap could suffer. If internal attention and talent are siphoned toward cryptocurrency endeavors, MicroStrategy might struggle to provide the same level of support and stability for its BI software users. There is also a more existential worry: MicroStrategy’s corporate fate is now tightly linked to the volatile crypto market. The company has effectively become a “hybrid investment vehicle combining software and Bitcoin” rather than a purely software-driven firm. This introduces new risks — as one industry analyst noted, the outsized role of cryptocurrency brings “volatility and regulatory uncertainties” that could “be seen as risky and/or a distraction to the company’s current customers.”

If Bitcoin prices were to crash or if regulators imposed restrictions, MicroStrategy’s financial position could be severely impacted. BI customers worry about scenarios where huge cryptocurrency losses force the company to cut budgets, lay off support staff, or even threaten the company’s viability. In the words of MicroStrategy’s own rebranding announcement, the company is now positioning itself as a Bitcoin treasury first – which makes BI users understandably nervous about whether the analytics platform will remain a priority in the future. Some observers even speculate that MicroStrategy could evolve into a financial services or banking-like entity focused on crypto holdings, with the software business potentially spun off or “managed separately” down the line.

All of these factors create a climate of uncertainty for organizations dependent on MicroStrategy’s BI technology.

Expert Opinions & Industry Reactions

MicroStrategy’s strategic pivot has not gone unnoticed by industry analysts and BI professionals, many of whom have voiced caution about relying on the company for critical analytics needs going forward. Melody Brue, principal analyst at Moor Insights & Strategy, highlighted the dilemma succinctly: the company’s Bitcoin-centric rebrand “signals dedication” to cutting-edge finance but “at the same time, cryptocurrency can be seen as risky and/or a distraction to the company’s current customers.”

Her view is that MicroStrategy’s identity shift – from a software vendor to a part software/part crypto investment play – introduces significant risk for enterprises that just want a stable BI platform. Brue notes that existing customers might perceive this crypto emphasis as a distraction from core BI competencies, potentially eroding their trust in the vendor.

The volatility of Bitcoin and unknown future of crypto regulation add layers of uncertainty that traditional BI vendors (who focus purely on software) simply don’t have to contend with. Other analysts echo these concerns. After MicroStrategy’s name change to “Strategy,” Boris Evelson, VP and analyst at Forrester Research, told the press that while he wouldn’t comment on the Bitcoin angle, he still considers MicroStrategy “a key player in the enterprise BI and analytics market.”

Evelson points out that the company has continued to update its product – for instance, integrating new generative AI features into the MicroStrategy platform – and that it retains technical strengths (like a robust semantic layer) built over decades.

This perspective suggests that the MicroStrategy BI software itself remains competitive from a technology standpoint, despite the parent company’s crypto fixation. However, even Evelson acknowledged that perception is a challenge: some clients have long viewed MicroStrategy as “legacy”, and the current publicity around Bitcoin could further overshadow the firm’s message about product innovation.

Importantly, the broader BI community appears to be responding with pragmatism – and wariness. Industry chatter indicates that many organizations are re-evaluating their analytics vendor strategy in light of MicroStrategy’s shift. For example, Gartner’s latest market research places MicroStrategy not among the top Leaders but in a challenger position, with Microsoft Power BI, Tableau, and others leading the BI pack.

Analysts note that these rival platforms have remained laser-focused on BI functionality and cloud innovation, without the distraction of a crypto agenda. The consensus among many experts is that businesses using MicroStrategy should “keep an eye on the exit” – meaning they should monitor the vendor closely and be prepared with alternatives if signs point to further neglect of the BI product. Some consultants advise clients to hedge their bets by running pilot projects with other BI tools or maintaining secondary BI solutions, just in case MicroStrategy’s roadmap falters. In sum, while MicroStrategy’s leadership insists that they can juggle both Bitcoin and BI, the sentiment in the industry is one of caution. Trust is wavering, and both analysts and customers are increasingly discussing contingency plans. As one commentary put it bluntly, MicroStrategy’s software business now feels “second” to its love of Bitcoin – a situation that makes CIOs and BI directors understandably nervous about the future.

Moreover, the business world has already seen a reaction in the form of migration to alternative BI platforms. BI professionals on community forums report that their companies are proactively switching away from MicroStrategy due to concerns about its strategic direction. This is not just theoretical – it’s happening in practice. For instance, one enterprise IT manager shared that because of MicroStrategy’s decision to invest so heavily in Bitcoin, their team flagged the vendor as a risk and made the choice to “move all reports to Power BI.”

Such reactions underscore how the expert warnings are translating into real-world decisions: organizations are reluctant to hitch their long-term BI strategy to a vendor whose priorities seem divided or uncertain.

Case Studies & Real-World Examples

Real-world examples are beginning to illustrate how MicroStrategy’s BI customers are responding to the company’s Bitcoin pivot. In the wake of MicroStrategy’s very public crypto bets, some clients have quietly started diversifying their BI toolsets or migrating to other platforms to mitigate risk. A telling case comes from an online forum: a company that had relied on MicroStrategy for 70% of its reporting decided to replace MicroStrategy with Microsoft Power BI entirely, after its IT department labeled MicroStrategy’s Bitcoin-centric strategy a serious risk

This is not an isolated incident. There are reports of other enterprises evaluating moves to Tableau, Looker, Qlik, and other BI solutions as a precaution against MicroStrategy’s uncertain future. Data on the BI market also reflect this shift. While MicroStrategy once vied as a top BI provider, today its market share is only on the order of 1–2%, compared to ~14% for Power BI and ~15% for Tableau.

In practice, many organizations have already standardized on these alternative platforms – and some former MicroStrategy customers have quietly joined that trend. The customer migration away from MicroStrategy can be seen in the company’s own financial results: maintenance revenues have flattened or declined, and new license sales have fallen, even as subscription (cloud) revenue grows modestly.

If the BI product’s momentum continues to wane and corporate strategy remains Bitcoin-first, many current customers may rethink their allegiance. While we haven’t seen high-profile public announcements of customer defections (companies tend not to broadcast switching BI tools), my own insights suggest that many MicroStrategy users are at least “shopping around”. The risk calculus is straightforward: no business wants to be caught using a critical BI system that might stagnate or whose vendor might pivot away entirely from software. We are already seeing precautionary migrations – the Migration from MicroStrategy to Power BI case is one clear example – and market indicators suggest more may follow if MicroStrategy cannot convincingly recommit to its BI core. Indeed, as one tech industry publication noted in early 2025, “the company formerly known as MicroStrategy has officially become a Bitcoin giant at the expense of its software business”, underscoring why some customers feel they have no choice but to look elsewhere.

Conclusion & Recommendations

MicroStrategy’s transformation from a BI software pure-play into a Bitcoin-focused entity presents a cautionary tale for its business intelligence customers. The strategic pivot has delivered windfalls for MicroStrategy’s stock and made it a poster child of corporate Bitcoin adoption, but it has also introduced significant business risks for organizations that depend on MicroStrategy’s analytics platform. BI leaders at those organizations need to tread carefully. Here are a few considerations and recommendations:

- Stay Informed on MicroStrategy’s Commitments: Keep a close eye on MicroStrategy’s communications and product roadmap. Has the company continued releasing BI upgrades and investing in its platform? Regularly review their quarterly earnings statements and product announcements for signs of ongoing BI innovation (or lack thereof). If the focus of their R&D and press releases tilts further toward crypto initiatives and away from analytics improvements, take note – it may signal that the BI platform is not getting the attention you require.

- Engage with the Vendor: If you are a current MicroStrategy customer, proactively engage your account managers and MicroStrategy’s leadership about these concerns. Ask direct questions about the company’s long-term BI strategy: Are they maintaining dedicated teams for BI R&D and support? What is the roadmap for new analytics features? How are they ensuring the BI business remains funded and viable regardless of Bitcoin market volatility? Gauge the responses – a credible, concrete plan to support BI customers for the long haul is a positive sign, whereas evasive or purely Bitcoin-focused answers should raise alarms. Vendors often give reassurances (for instance, MicroStrategy’s management has repeatedly stated they remain committed to BI customers), but it’s important to get specifics and judge if those promises are being kept.

- Assess Your Risk Tolerance: Evaluate how much risk your organization can tolerate in its BI vendor. If business intelligence is mission-critical to you (as it is for most enterprises), consider whether you are comfortable with a provider that is simultaneously acting as a cryptocurrency investment vehicle. For some companies with high risk tolerance and perhaps even an interest in cryptocurrency, MicroStrategy’s dual focus might be acceptable or even attractive. But for many, the uncertainty and potential instability (financial or operational) that come with MicroStrategy’s Bitcoin strategy will be unacceptable in a core enterprise system. Be honest about your risk appetite – if it’s low, that tilts toward a decision to reduce dependence on MicroStrategy.

- Evaluate Alternative BI Platforms: Given the situation, it is prudent for current MicroStrategy customers to research and even trial alternative BI solutions. Competing platforms like Microsoft Power BI, Tableau (Salesforce), Google Looker, Qlik, and others each have their strengths. Many of these vendors are eager to win over disaffected MicroStrategy users and offer robust migration tools or incentives. Start by identifying which platform best fits your needs (in terms of data integration, ease of use, scalability, cost, etc.) and perhaps run a proof-of-concept using your own data. Even if you do not switch immediately, having hands-on familiarity with an alternative will reduce switching costs and lead time if you eventually decide to migrate. In fact, some organizations are adopting a multi-BI strategy – continuing to use MicroStrategy for certain legacy reports or complex applications, but introducing a newer tool like Power BI or Tableau for new projects or self-service analytics. This can be a stepping stone that hedges your bets and gives end-users exposure to other tools.

- Plan for a Potential Transition: It’s wise to develop a contingency plan in case you need to fully transition off MicroStrategy. This doesn’t mean you must execute it now, but you should have one “on the shelf.” Inventory your MicroStrategy reports, dashboards, and data models; assess how difficult they would be to recreate on another platform (here you can read more about our approach to MicroStrategy Migrations). Prioritize which analytics applications are most critical and would need to be moved first. Address data portability – ensure you can access your underlying data warehouses or marts independently of MicroStrategy’s semantic layer. Also, consider contractual aspects: review your MicroStrategy license agreements for renewal dates, termination clauses, and any post-termination access to your content. The goal is to avoid being caught flat-footed; if MicroStrategy’s BI offering were to deteriorate rapidly or the company’s situation became untenable, you want the option to pivot to an alternative with minimal business disruption.

- Remain Agile and Watch the Trends: The BI and analytics landscape is dynamic, and so is MicroStrategy’s unique situation. It’s possible (though many would say unlikely) that MicroStrategy’s Bitcoin gambit pays off in a way that ultimately benefits its BI customers – for example, an influx of capital that gets reinvested into improving the product. It’s also possible MicroStrategy could change course (e.g. spinning off the BI unit or selling it to a firm that would refocus on software). Keep abreast of any such developments. In the meantime, maintain some agility in your BI strategy. Favor open standards and interoperability where you can, so that no single vendor (MicroStrategy or otherwise) has undue lock-in on your data analysis capabilities.

In conclusion, companies currently using MicroStrategy should approach the future with eyes wide open. The analytics platform itself may still be powerful, but the vendor’s strategic priorities raise legitimate concerns. By monitoring MicroStrategy’s actions, engaging in frank discussions, and preparing alternative options, BI customers can protect themselves against the downside risk. The overarching recommendation is to not “put all your chips” on MicroStrategy given its leadership’s clear fixation on Bitcoin. As the saying goes, hope for the best (that MicroStrategy will continue to support and evolve its BI product) but prepare for the worst. In practice, that means ensuring your organization can seamlessly pivot to a more stable BI platform if and when the time comes. By taking these proactive steps, businesses can mitigate the risks of MicroStrategy’s Bitcoin-focused strategy and continue to drive their BI initiatives forward with confidence, whichever platform they ultimately choose.